NGO Registration

Mybusiness Filings Latest Blog Post

NGO Registration

Overview of NGO Registration

NGO is a non-profit organization that functions independently. In India, NGOs can be registered as a Society, Trust and section 8 companies depending on the activity an individual wishes to undertake. A Non-Profit Organization is a voluntary group or institution that works for a social cause.

In common understanding of the status, NGOs are involved in carrying out the activities at a wide range only for the benefit of the society at large. The activities performed by the NGOs include but are not limited to-Environmental, Social, Advocacy and human rights work. NGOs work to promote social or political change on a wider scale and also play a critical part in developing society, improving communities, and promoting citizen participation. There are three legal ways an NGO can be registered, which are as follows: - (1) Trust (2) Societies & (3) Section 8 Companies.

What are the benefits of NGO Registrations in India?

Below-mentioned are the benefits of NGO Registration:-

- Avails Tax Exemption

Registering the company as an NGO under the Companies Act, 2013 helps in availing several taxation benefits i.e. NGOs are exempt from several taxes which as result helps the company save money from taxes and utilizing the saved money in further projects.

- Right To Acquire Assets

When your organization is officially registered, it then becomes permitted to acquire land, own fixed assets and/or acquire liabilities under its common seal. It is against the law for an unregistered organization to buy, hold/sell land anywhere.

- No Minimum Share Capital Requirement

No minimum share capital requirement is needed to function independently. NGOs can be directly funded with the charity made to them. This means that NGOs do not need a higher share capital to function independently.

- Protection From Personal Liability

You can buy, acquire & register assets and stakes in the name of your NGO. This is a very well-groomed way of protecting by hand from unlimited liability for untoward occurrence such as foreclosure, bankruptcy, judgment debt, or divorce etc.

- Transfer Of Ownership

Under the Income Tax Act 1961 NGOs registered under the Companies Act, 2013 are not restricted to transfer their ownership or claims of the interests earned.

- Corporate Entity

As a corporate body, your organization’s transactions and engagements with the community will improve. The NGO can also sue to enforce its legal rights or be sued via its registered trustees.

- Exemption On Stamp Duty

Under Income Tax Act, Section 8 companies as NGOs are exempted from stamp duty, which results in more tax-saving methods for the company. All the taxes saved through stamp duty are then invested in the promotion of the objectives taken up by the company. Also, it helps in protecting funds for the company, which as a result helps in smoother functioning of the company and increasing the productivity of the company.

- Structured Financial Plan

Having an NGO can bear a tax-free mechanism for actions you are carrying-on under the registered NGO. NGOs are considered not-for-profit and tax exempted. You can develop a structured financial plan that allows the organization to do business devoid of tax liabilities.

- Stability Of Entity

The registration of your organization can suggest that there is effective and responsible leadership in place. The public will perceive same as being stable than an unregistered organization. Political parties, government, donor agencies, financial institutions, charity organizations and other NGOs will want to partner with a registered body to further common objectives.

- Perpetual Succession

This means an NGO got an unlimited lifetime and will carry on existing even if the founder/trustees die or leave the NGO. The organization’s continuation will only cease if it is formally wound up by the Order of Court of India. Along with other benefits, this may allow perpetual succession.

- Admission To Credit

Registering an NGO can afford access to credit from lenders and financial institutions. You can use a loan facility to promote the organization’s activities, finance a mortgage, acquire land or fixed assets. Banks will want to see proof of registration with condition precedent to giving a loan.

- Name Preservation

Once your organization is registered, no one can use the same name or name similar to it throughout in India. This has the benefit of protecting your corporate image and name from unauthorized use.

- Opening Bank Account

Opening a corporate account with a bank for the NGO may signal the fact that is transparent. Some private persons, government, donor agencies and other NGOs will not be comfortable writing you a cheque for your organization in your personal name. A bank account for the NGO would signal its corporate existence and its readiness to receive donations. You need to provide proof that your organization is registered to be able to open an account with a bank.

What is the Classification of NGOs in India?

NGOs are classified based on the following levels, which are as follows:-

- By the level of Orientation.

- By the level of Operation.

By The Level Of Orientation

- Charitable Orientation

- Service Orientation

- Participatory Orientation

- Empowering Orientation.

By The Level Of Operation

- Community-Based Organization

- City Wide Organization

- National NGOs

- International NGOs.

What are the Types of NGO Registration in India?

In India, an individual is free to perform social activities without structuring an entity or organization. However, an individual wants to form a group that involves participants, activities, and resources, it is essential to have proper management in place.

To run the NGOs in the form of (Companies, Trusts, and Societies) in an accurate manner, a certain set of rules need to be followed. To register any of the below-mentioned ways, an applicant needs to follow the various laws. NGO registration can be done in 3 ways:-

- Trust Registration under “The Indian Trust Act, 1882”

- Society Registration under “Societies Registration Act, 1860”

- Section 8 Company Registrations under “The Companies Act, 2013”

What Documents are Required for NGO Registration?

Before a registered deed is delivered to an NGO, the Below-mentioned documents are required:-

For Trust Registration

- Objective of the Trust Deed.

- Particulars of the Trustee and settlor (Self-attested copy Id and Address Proof along with the information related to occupation).

- Trust Deed on Proper Stamp Value.

- Photographs of Trustee and settlor.

- PAN Card of Trustee and settlor.

- Documentation for the Trust Registered Address. In the case of rented property (NOC from the Landlord is required).

For Societies Registration

For a society registration, below-mentioned documents are required:-

- Name of the society

- Address proof of the working space.

- Identity proof of all the 9 members

- 2 copies of the Memorandum of Association and By-laws of the society

For Section 8 Companies Registration

- Copy of Identity Proof and Address Proof (Including PAN Card).

- DIR-2(Consent of the directors) along with ID& Address proof

- Utility bill not older than 2 months

- Proof of registered office address

- No objection certificate is required if the registered office is not taken on rent.

- Affidavit regarding deposits

- INC-14 -Declaration by Professionals

- INC-15-Declaration by Promoters (INC-14 and INC-15 shall be on the stamp paper, duly notarized).

- Estimated Annual Income

- Memorandum of Association and Articles of Association

- Particulars of the promoters as well as Board Members of the proposed company

What is the Procedure for NGO Registration?

Based on type of NGO Registration (Trust, Societies and Section 8 companies), an applicant needs to follow various laws and procedure prescribed in the respective act.

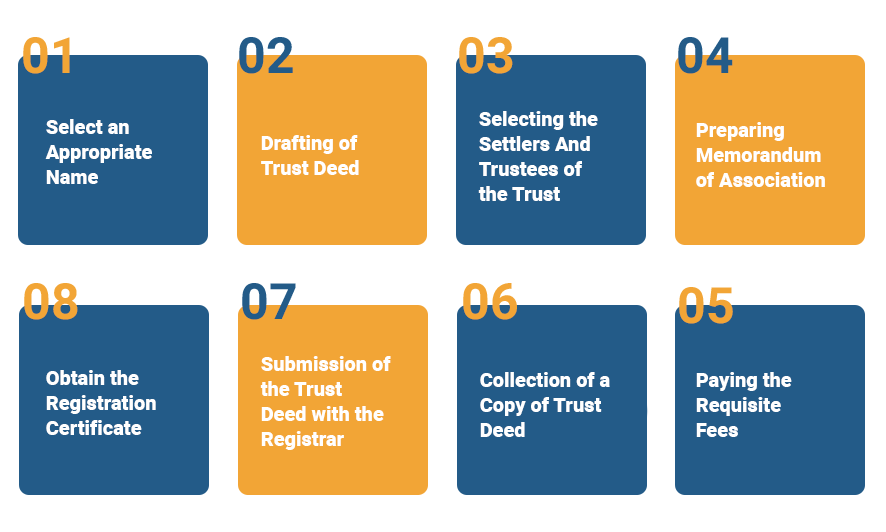

NGO Registration Procedure (As A Trust)

The procedure for Trust registration involves the below-mentioned steps-

- Select An Appropriate Name

The very first while registering the Trust is to select an appropriate name for the trust. An applicant must take into consideration that the name so suggested should not come under the restricted list of names as per the provisions of the Emblems and Names Act, 1950.

- Drafting Of Trust Deed

For the purpose of Trust registration, the Trust deed should be drafted. A trust deed is a document that contains all the important information related to the registration and the deed must be present before the Registrar at the time of registration.

- Selecting Settlers And Trustees Of The Trust

The next step is to select the settlor and Trustees of the Trust. However, there is no specific provision with regards to the number of settlers/authors. Further, there must be a minimum of two trustees to form a Trust.

- Preparing Memorandum Of Association

For Trust registration it is important to formulate the Memorandum of Association as it represents the charter of the Trust.

- Paying The Requisite Fees

The next step is to pay a requisite fee for Trust registration.

- Collection Of A Copy Of Trust Deed

Once an applicant submits the papers; he/she can collect a certified copy of the Trust Deed within 1 week from the registrar’s office.

- Submission Of The Trust Deed In Registrar

After obtaining a certified copy of the Trust Deed, submit the same with the local registrar. The Trust deed shall be submitted along with properly attested photocopies.

- Obtain The Registration Certificate

After submitting the Trust Deed with the registrar, the registrar keeps the photocopy and returns the original registered copy of the Trust Deed to the applicant, and also issues the certificate within seven working days.

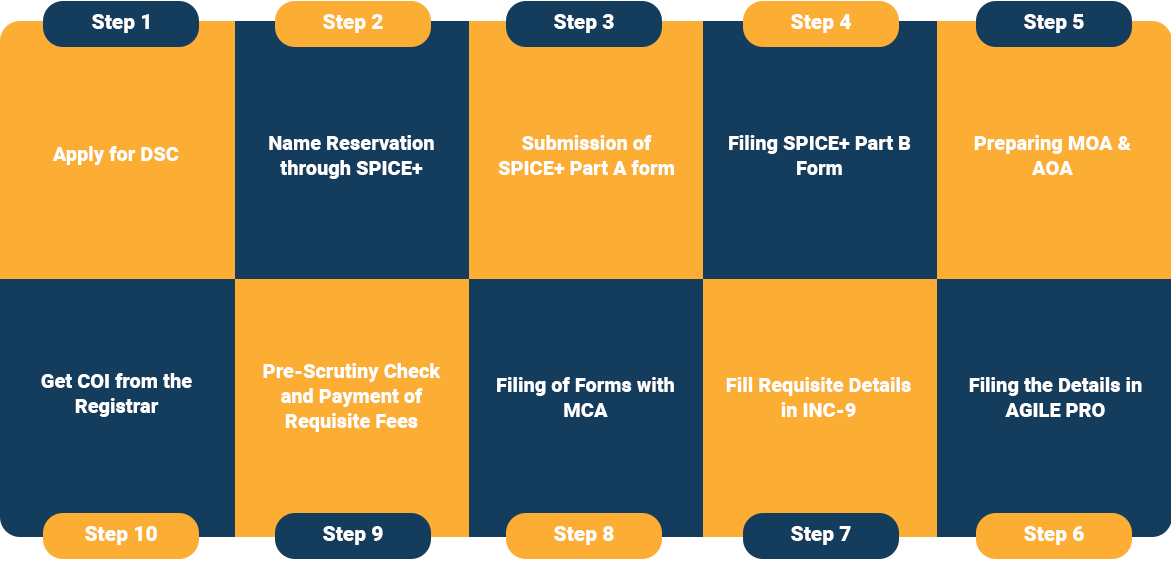

NGO Registration Process As (Section 8 Company)

For NGO registration as Section 8 Company, an applicant needs to follow the below-mentioned steps:-

- Step-1-Apply For DSC

The very first step is to apply for the Digital Signature Certificate. DSC is used for affixing the signature in the electronic forms.

- Step 2: Name Reservation Through SPICE+

The procedure for name reservation of Section 8 Company is similar to other companies. For the same, click on the ‘SPICe+’ Form placed under ‘MCA Services’. SPICE+ form is used for name reservation of the company that includes all the steps right from the Name Reservation to Post incorporation compliances.

The applicant of Section 8 Company has to fill the name he/she wants to reserve for Section 8 Company. Provided the name shall include the words, such as:-

• Federation,

• Chambers,

• Foundation,

• Forum,

• Association,

• Confederation,

• Council, and the like, etc.

- STEP-3-: Submission Of SPICE+ Part A Form

The applicant needs to submit the SPICE+ Part A form for Name reservation and incorporation purposes. (DIN Application is also included in the SPICE+ form).

- Step-4-Filing SPICE+ Part B

After submitting the SPICE+ Part A, the next step is to download SPICE+ Part B in PDF for incorporation purpose in format for filling the related forms are-

• SPICe+AoA,

• SPICe+MoA,

• AGILE-PRO,

• INC-9 and URC-1) and for affixing the “DSC,”.

- Step-4-Preparing MOA & AOA

After the proper filing of the SPICE+ form, an applicant has to file MOA and AOA form Dashboard Link. All the details which are common in PART-B shall be auto-fill in MOA and AOA. Both the forms are web-based forms.

An applicant is required to fill in all the details in the MOA/ AOA as per the requirement of Schedule I. Also, affix the Digital Signature Certificate of all the subscribers and professional on the portal for the same.

- Step 5: Filing The Details In AGILE PRO

The next step is to fill all the details in the AGILE PRO form. Similar as Part A, the details that are common in PART-B shall be auto fill in AGILE Pro. AGILE PRO includes-

• GST-Optional

• EPFO/ ESIC- Mandatory

• Bank Account- Opening the bank account through this form.

- Step 6: Fill Requisite Details In INC-9

INC-9 includes the declaration by the subscriber or First director.

- Step 7: Filing Of Forms With MCA

An applicant shall file the respective forms with MCA after filling all the requisite details in SPICE+ and AGILE PRO. After successful submission, the documents can be submitted, and DSC can be affixed in the respective form.

- Step-8-Pre-Scrutiny Check And Payment Of Requisite Fees

The next step to be followed is to do a pre-scrutiny check. After a successful Pre-scrutiny check, the applicant must click on the confirmation button. Also, the applicant company is required to pay a requisite fee for “Section 8 Company” registration.

- Step-9-COI From The Registrar

If the Registrar finds the information and the documents appropriate; he will issue a Certificate of Incorporation to the applicant company.

NGO Registration Process As (A Society)

For NGO registration as a Society, the founding members must first choose-A unique name for the Society and, Preparing the Memorandum of the Society

- Choosing A Name For Society

While selecting a name for the society, it is essential to keep in mind that as per Societies Act, 1860, that name should be unique and un-identical. Further the name proposed by the applicant must also not suggest patronage of the Government of India or any State Government or attract the provisions of Emblem and Names Act, 1950.

- Preparing The Memorandum Of A Society

While registering the society, an applicant shall prepare the Memorandum of society. The Memorandum of the Society along with the Rules and Regulations of the Society must then be signed by each of the founding members, witnessed by-

• An Oath Commissioner,

• Notary Public,

• Gazetted Officer,

• Advocate,

• Chartered Accountant or

• Magistrate 1st Class with their official stamp and complete address.

- Prepare Documents

An applicant shall prepare the below-mentioned documents required for Society registration. The documents shall be duly signed.

• Name of the society

• Address proof of the working space.

• Identity proof of all the 9 members

• 2 copies of the Memorandum of Association and By-laws of the society

- Filing Of Application

An applicant shall file the signed Memorandum and Rules and Regulations with the concerned Registrar of Societies in the State with the prescribed fee.

- Get Society Certification

Once the documents are submitted and the Registrar is satisfied with application for Society Registration, he would certify to deem the Society to be registered.

Recent Notification on NGOs- 2021

As per the recent notification, the Ministry of Home Affairs has extended the validity of registration certificates issued to Non-Profit Organizations under the Foreign Contribution (Regulation) Act, expiring between 29th September 2020 to May 31, 2021.

For NGOs receiving foreign funding it is mandatory to register under the FCRA and the decision is expected to be advantageous for various NGOs and other voluntary entities whose registrations have expired since September 29, 2020.

Further, MHA said it is necessary to administer the FCRA and section 12(6) of the act that specifies that the certificate granted shall be valid for a period of 5 years from the date of issue.

Difference Between - Trust, Society & Section 8 Company

Meaning

- Trust is an agreement between parties, whereby one party holds the ownership of property for the benefit of another party.

- Society is a collection of persons, who come together for initiating any literary, scientific or charitable purpose.

- Section 8 is a company formed with social or charitable object which intends to apply its profits for promoting such purpose.

Name Prefixing

- As NGO/ NPO, only Section 8 enjoys the privileges of a limited company without using the words “Limited” or “Private Limited” in its name.

Governing Law

- In case of Trust, the Indian Trusts Act, 1882 governs Private Trusts, while general law governs Public Trusts except states like Gujarat, Maharashtra where they have separate public trust acts.

- In case of Society, the Societies Registration Act, 1860 governs societies.

- In case of Section 8 Company, the Companies Act, 2013 governs section 8 companies.

Registering Authority

- In case of Trust, Deputy Registrar of the relevant area is the registering authority.

- In case of Society, Registrar or Deputy Registrar of Societies of the State is a registering authority.

- In case of Section 8 Company, Registrar of Companies (ROC) or Regional Director is a registering authority.

Minimum Members

- In case of Trust, minimum 2 trustees are required to form trust.

- In case of Society, minimum 7 members are required to form society.

- In case of Section 8 Company, minimum 2 directors and minimum 2 shareholders are required. Same person can be appointed as director and shareholder in a company.

Geographical Area Of Operation

- In case of Trust, whole India

- In case of society, state wise, but can operate in whole India after becoming National Level Society.

- In case of Section 8 Company, whole India.

Supporting Formation Document

- In case of Trust, Trust Deed

- In case of Society, Memorandum of Association and Rules & Regulations

- In case of Section 8 Company, Memorandum of Association and Articles of Association.

Legal Title Of Property

- In case of Trust, title of the property vests in the hands of trustees.

- In case of Society, title of the property held in the name of the society.

- In case of Section 8 Company, title of the property held on the name of the company.

Cost Factor

- In case of Trust, cost is low.

- In case of Society, cost is medium.

- In case of Section 8 Company cost is bit high.

Grant Of Subsidy By Government

- In case of Trust, not much preferred.

- In case of Society, not much preferred.

- In case of Section 8 Company, highly preferred.

Tax Exemption Under The Income Tax Act, 1961

- In case of Trust, yes allowed.

- In case of Society, yes allowed.

- In case of Section 8 Company, yes allowed.

Preference (FCRA) Registration

- In case of Trust, not much preferred.

- In case of Society, not much preferred.

- In case of Section 8 company, mostly preferred.

Transparency In Working

- In case of Trust, bit of shady.

- In case of Society, not much.

- In case of Section 8 Company, high -because of online availability.

Annual Compliance Requirement

- In case of Trust, few annual compliances are required depending upon the type of trust such as Private trust or Public Trust.

- In case of Society, annual filing of list of names, addresses and occupations of members of the Managing Committee of the society is mandatory with the Registrar of Societies.

- In case of Section 8 Company, annual compliances of filing of accounts and filing of annual return are mandatory with the Registrar of Companies (ROC).

Mybusinessfilings Procedure for NGO Registration

Kindly utilize the steps given above to integrate legally and securely a NGO Registration and get the benefits in the form of better-quality charitable activities. Our Mybusinessfilings experts will be at your disposal for assisting you with guidance concerning NGO Registration and its compliance for the smooth functioning of your NGO operations in India. Mybusinessfilings professionals will assist you in planning seamlessly at the least cost, confirming the successful conclusion of the process.

It is advisable that an attorney with “NGO experience” must be appointed to overwhelm many of the potential pitfalls that creep around within NGO Registration and to understand the requirement in detail. The elementary information would be mandatory from your end to start the process. The Attorney will begin working on your request once all the information is provided, and the payment is received.

NGO is a non-profit organization that functions independently. In India, NGOs can be registered as a Society, Trust and section 8 companies depending on the activity an individual wishes to undertake. A Non-Profit Organization is a voluntary group or institution that works for a social cause.

Comments :